This simple, easy-to-understand tool can tell you what you need to know upfront so you know what to focus on if there are any issues or room for improvement. A financial professional will be in touch to help you shortly. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Why You Can Trust Finance Strategists

Anushka will record revenue (income) of $400 for the sale made. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from big data and analytics the customer in the future. As inventory (asset) has now been sold, it must be removed from the accounting records and a cost of sales (expense) figure recorded.

Owners’ Equity

This arrangement is used to highlight the creditors instead of the owners. So, if a creditor or lender wants to highlight the owner’s equity, this version helps paint a clearer picture if all assets are sold, and the funds are used to settle debts first. A lender will better understand if enough assets cover the potential debt.

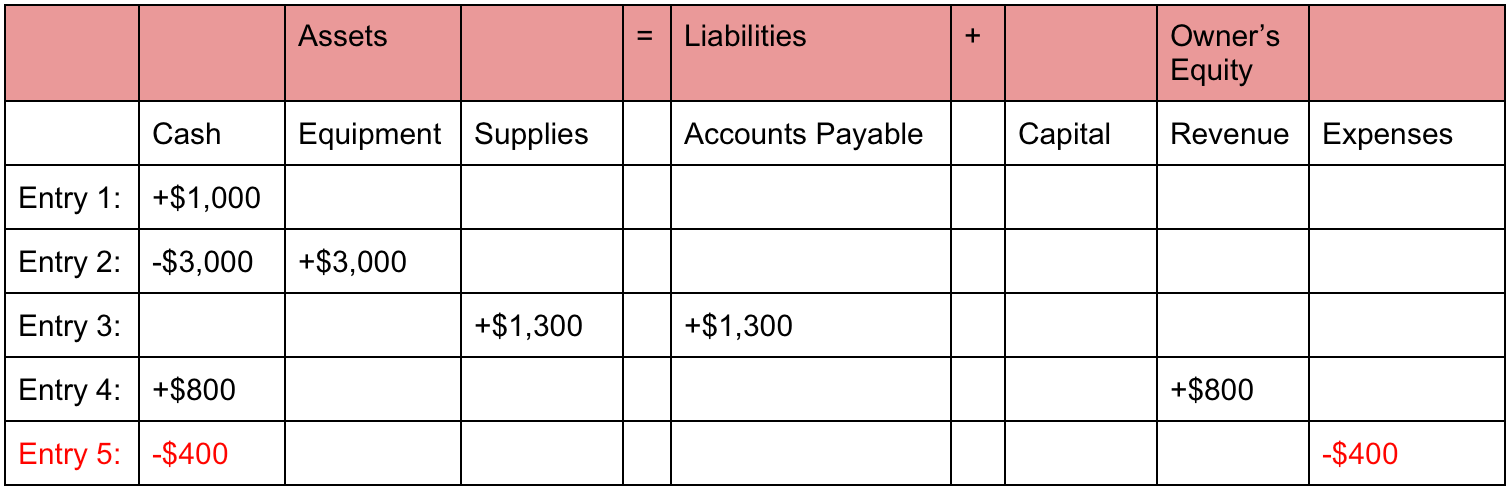

Effect of Transactions on the Accounting Equation

- In above example, we have observed the impact of twelve different transactions on accounting equation.

- It’s a tool used by company leaders, investors, and analysts that better helps them understand the business’s financial health in terms of its assets versus liabilities and equity.

- In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings.

- Assets typically hold positive economic value and can be liquified (turned into cash) in the future.

In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly. Thus, the accounting equation is an essential step in determining company profitability. This straightforward relationship between assets, liabilities, and equity is considered to be the foundation of the double-entry accounting system.

That is, each entry made on the Debit side has a corresponding entry on the Credit side. It’s a tool used by company leaders, investors, and analysts that better helps them understand the business’s financial health in terms of its assets versus liabilities and equity. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit). The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity. For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K).

Double entry bookkeeping system

For example, you can talk about a time you balanced the books for a friend or family member’s small business. This long-form equation is called the expanded accounting equation. On the other hand, equity refers to shareholder’s or owner’s equity, which is how much the shareholder or owner has staked into the company. Small business owners typically have a 100% stake in their company, while growing businesses may have an investor and share 20%. The accounting equation focuses on your balance sheet, which is a historical summary of your company, what you own, and what you owe.

That’s why you’re better off starting with double-entry bookkeeping, even if you don’t do much reporting beyond a standard profit and loss statement. On 5 January, Sam purchases merchandise for $20,000 on credit. As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets. As business transactions take place, the values of the accounting elements change. Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems.

Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. For now, let’s just keep things simple and think about how we can expand to basic accounting equation into an expanded accounting equation. The accounting equation is not always accurate if it is unbalanced. This can lead to inaccurate reporting of financial statements and incorrect decisions made by management regarding money and investment opportunities.